Peer Lending Advisors manually underwrites every loan, which includes reviewing every borrower’s employer and ensuring they have a steady job. A basic guiding principle is that people with unsteady jobs (think minimum wage and high-churn jobs) have higher default rates, and people with secure jobs (e.g. secure employers like the government and highly skilled jobs) have lower default rates. The models prove this out.

The impact of employer is a complicated question, and for the purposes of this post, I have massively simplified the analysis by isolating the impact of employer and restricted the data set.

What is the impact of employer on Peer-to-Peer Loans?

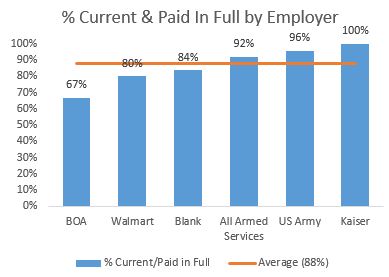

To demonstrate the impact of employer, I looked at loans that were issued from May & June 2011, and looked at the % of loans that were current or paid-off for various employers.

There’s definitely a correlation between employer and default rate:

- Bank of America: Retail banking is a very high-turnover industry. While it takes some education to work at Bank of America (BOA), tellers are paid poorly and typically don’t enjoy their job, which results in high turnover. I am very cautious with employees of BOA, Chase, or the other big banks. And the data proves this is a wise decision: only 2/3 of borrowers from BOA are current after two years for the selected data set.

- Walmart: Everyone knows the struggle that employees at Walmart go through. Unionization is prohibited, and employment is tenuous. Only 4 out of every 5 borrowers are current that work at Walmart after 2 years of borrowing at Lending Club. Peer Lending Advisors is very cautious before investing in loans for employees at Walmart, despite supporting the efforts of all people to refinance their debt at lower interest rates and improve their credit and employ-ability.

- Blank: Some borrowers don’t list an employer. Some of these borrowers are self-employed. Others choose not to share employer information. Peer Lending Advisors treads carefully with these borrowers, looking at supplemental information before deciding to invest. Total disclosure is preferred – loans that include full information about employer and the uses of funds are most likely to pay back their loan. Indeed, people that leave employer blank are more likely to default than average.

- Armed Services / US Army: Contrary to the examples above, employees of the Armed Services are much more trustworthy; employees of the armed services have a very low default rate. In particular the US Army is highly likely to pay back loans. This is not surprising: the military teaches discipline and pays well, and members of our armed services often work hard to get on the right track. This is not the case of all government employees: for example, the USPS has slightly below-average repayment rates, so it’s important to review risk and employer.

- Kaiser Permanente: Peer Lending Advisors loves healthcare jobs. Kaiser certainly proves this, with 100% of loans paid in full or current after 2 years. We review all jobs and attempt to isolate healthcare jobs, which often are reflected with perplexing acronyms, which can only be solved by searching and using relevant information in the loan application (such as city). With the huge population of baby boomers currently reaching social security age, this segment will continue to yield high job security and positive returns in Peer-to-Peer Lending.

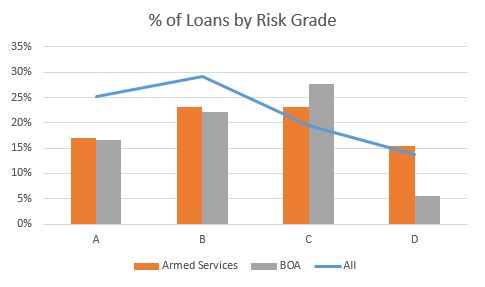

What about risk-adjusted returns?

For simplicity in the above analysis, I ignored risk and did not adjust returns for risk factor in the above analysis. Did it have an effect on returns?

Risk-adjusted distribution of loans shows that this analysis still stands. Armed Services loans have a much higher proportion of “D” loans (along with a higher interest rate) than “A”, “B”, and “C” loans. This means that while Armed Services Loans have a lower default rate, they also have a higher interest rate. This is best-case scenario! Clients of Peer Lending Advisors benefits doubly from this: higher interest rates and lower default rates.

Interested in working with Peer Lending Advisors and lending peer-to-peer?

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Phone’ type=’text’/][/contact-form]